Perception Point, a cybersecurity firm whose unique cloud-based, CPU-level technology intercepts advanced attacks at the earliest possible stage of execution, today announced it has raised $8 million in Series A funding. The company already offers an advanced email protection solution, and will use the funds to expand its global presence and product portfolio. The round was led by Pitango Venture Capital along with State of Mind Ventures (SOMV) and Korea Investment Partners (KIP). Rami Kalish from Pitango will join Pinhas Buchris from SOMV on the Perception Point board of directors.

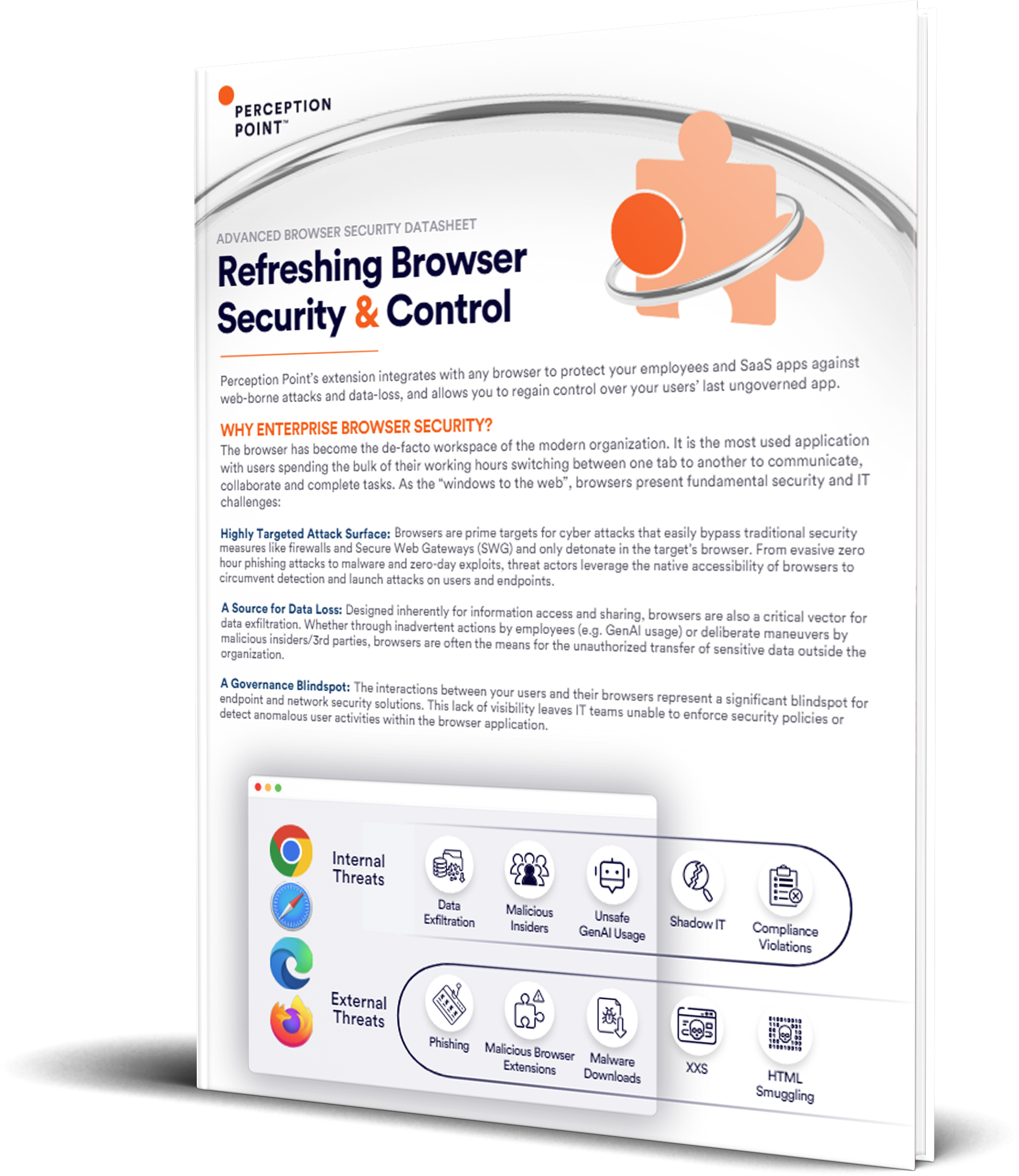

Founded in 2015 by Israeli cyber-intelligence experts, Perception Point has developed a platform blending the best of hardware and software capabilities to detect exploits before hackers are able to penetrate an organization. Exploit techniques become visible well before malware is released into a system and able to cause damage or loss. Perception Point employs proprietary algorithms to examine data at an earlier stage than other solutions, directly accessing a computer system’s CPU to detect and prevent attacks prior to exploitation, without delays or scale limitations. The company’s initial product is a cloud-based, multi-layer e-mail protection solution that is uniquely able to protect against every level of threat, from phishing through to the most sophisticated attacks, known as N-Days and Zero Days.

Yoram Salinger, CEO of Perception Point, noted, “Companies across industries are undergoing a transformation. As more and more move to the cloud, they require security solutions that are equivalent in terms of speed, scale and flexibility, while also being effective against the more advanced types of threats. At Perception Point, we saw an opportunity to serve both requirements – fusing the flexibility of a cloud solution with the threat visibility only possible at a CPU level.”

Rami Kalish, Managing General Partner and Co-Founder of Pitango Venture Capital, stated, “We are very enthusiastic about supporting Perception Point at an early stage. The company fills an urgent need for robust, next generation cyber-defense technology and is uniquely well- positioned to capitalize on a market for APT protection that is expected to grow to $7.3 billion in the next few years.” Pitango, one of Israel’s leading venture capital investors, is providing the majority of the Series A round and Mr. Kalish is joining the company’s board of directors. He currently serves on the boards of Avantis Team, ForeScout Technologies, Neura and DD-ID, and was previously a board member of SkyCure (acquired by Symantec) and Redbend (acquired by Harman).

Pinhas Buchris, General Partner of SOMV, said, “Having provided the seed funding for Perception Point, we are excited to see how the company and its groundbreaking technology have advanced. With the migration of many IT systems to the cloud and the increased sophistication of cyberthreats, organizations have a greater need than ever to apply comprehensive cyber-protection solutions. We are proud to support Perception Point as it brings to market innovative solutions to today’s toughest cybersecurity challenges.” Mr. Buchris has

been on the Perception Point board since 2015. He was formerly Managing Director of the Israeli Ministry of Defense and headed the “8200 division” where he led many of Israel’s cyber programs.

About Perception Point.

Perception Point is powered by several decades’ experience successfully developing and implementing innovative cybersecurity solutions for organizations worldwide. With our proven R&D leadership formerly playing key roles within the elite Israeli Intelligence Corps, we are committed to pioneering the discovery and disablement of new exploit techniques industry-wide. Our strategy is to protect all file and URL exchanges across the enterprise, through any channel, with one holistic cloud-based solution.

About Pitango Venture Capital.

Pitango has been investing in technology ventures since 1993 and now has more than $2 billion under management. Pitango invests in Israeli tech and healthcare companies, in various fields and all stages. Pitango Venture Capital has invested in over 200 companies, many of which have become public or were acquired by strategic players.

About State of Mind Ventures.

State of Mind Ventures is an innovative early stage venture capital fund, investing in game- changing, technology-driven Israeli start-ups. We identify visionary technology teams and help them build world-class companies that influence and shape the business environments around them. The teams we invest in are driven by powerful, differentiated technologies that stand out in the fields of cyber, semi-conductors, communications, cloud, big-data, computer vision, sensors, robotics, and aerospace, in which Israeli companies excel.