What Is CEO Fraud?

CEO fraud is a type of phishing scam that involves cybercriminals posing as company executives to deceive employees, customers, or partners into transferring money or sensitive information. CEO frauds exploit the authority of the CEO’s position to pressure targets into making hasty decisions without the usual verification processes.

Typically executed through email phishing tactics, scammers conduct detailed research to mimic the executive’s communication style and timing their fraudulent requests cleverly to coincide with periods when the executive is less accessible. They use a combination of social engineering and technical measures such as domain name and email account spoofing, which can make the phishing attack more convincing.

CEO frauds can lead to huge financial losses and breach of sensitive information. Companies affected by such scams may find their internal security measures questioned, leading to a loss of confidence among investors, partners, and customers. This makes it critical to take organizational measures and put cybersecurity solutions in place to mitigate the threat.

In this article

5 Techniques Used for CEO Fraud Phishing

Here are the common ways attackers carry out CEO fraud. Attackers might combine more than one of these techniques to make their phishing message more convincing and difficult to detect:

- Email account Takeover: Criminals take over an authentic email account of a CEO through credential phishing attacks. This method is highly effective because victims rarely question emails sent from the CEO’s actual email address.

- Domain name deception: Fraudsters create email addresses that are nearly identical to legitimate ones, for example by changing just one character or using similar characters. This subtlety can easily trick employees into believing the email is authentic.

- Display name spoofing: Criminals manipulate the display name to make an email appear to be from a legitimate executive, even though the actual email address is incorrect. Employees may not scrutinize the email address closely, leading to successful deception.

- Email header spoofing: Attackers design email headers to resemble those used by the organization, enhancing the email’s authenticity and making it harder to detect the fraud.

- Generative AI: Modern generative AI tools can generate phishing messages that can convincingly replicate the style and tone of a CEO’s emails, based on a few examples.

Related content: Read our guide to phishing detection

Tal ZamirCTO, Perception Point

Tal Zamir is a 20-year software industry leader with a track record of solving urgent business challenges by reimagining how technology works.

TIPS FROM THE EXPERTS

- Simulate multi-vector phishing attacks

Train your staff using advanced simulation exercises that incorporate various tactics such as phone-based social engineering combined with email phishing. This helps employees practice spotting more sophisticated, multi-channel attacks that mimic real-world scenarios. - Develop a robust incident response playbook

Create a specific incident response plan for CEO fraud attempts, including a clear chain of communication and predefined steps for verification, containment, and reporting. This ensures swift, coordinated action if an attack is suspected or detected. - Implement a “trusted word” system

Establish a confidential, pre-agreed-upon word or phrase between executives and key personnel involved in sensitive transactions. This word can be used in verbal or written communication to authenticate requests, making it more difficult for fraudsters to succeed even if they gain access to email accounts. - Leverage AI-powered email security

Integrate AI-driven email security to monitor unusual patterns in executive communications. Alerts triggered by these anomalies can serve as early warnings of potential email compromise.

Targets of CEO Fraud

Here are the most common targets of CEO fraud campaigns.

Finance

The finance department’s access to company funds and financial operations makes it a prime target for CEO fraud. Attackers focus on this area because it often handles requests for wire transfers and manages sensitive financial information. They might send an email that appears to come from the CEO, requesting an urgent wire transfer to a specified account for a seemingly legitimate business purpose.

Human Resources

Human Resources departments are targeted due to their access to personal employee information and their role in processing financial transactions related to payroll. Attackers often target HR personnel with emails that mimic senior executives’ requests for confidential employee data or changes to bank account details for salary payments. The objective is to acquire sensitive information or redirect funds to an attacker-controlled account.

Executive Team

The executive team, comprising senior leaders and decision-makers within an organization, represents a high-value target for CEO fraud due to its access to sensitive company information and financial authority. Attackers aim to compromise the email accounts of these individuals to initiate fraudulent financial transactions and to gather intelligence for further scams.

IT

The IT department is a critical line of defense against CEO fraud, with access and control over company networks and email systems. Attackers targeting IT staff aim to gain privileged access that could allow them to impersonate executives and initiate unauthorized actions without detection.

How Can Your Organization Identify CEO Fraud?

Identifying CEO fraud requires vigilance and an understanding of common tactics used by fraudsters. The following are common indicators:

- Unexpected urgency: Be wary of emails that press for immediate action, especially those involving financial transactions or sensitive information. Fraudsters often create a sense of urgency to bypass normal verification processes.

- Request for secrecy: Emails demanding confidentiality, particularly around financial matters, should raise red flags. This tactic aims to isolate the recipient and discourage them from seeking validation or advice.

- Changes in payment details: Any request to change bank account details for payments should be verified independently through known contact methods, not by replying to the email.

- Unusual email addresses: Check the sender’s email address for slight deviations from the company’s standard email format. Fraudsters may use addresses that closely mimic legitimate ones.

- Mismatched language and tone: If the email’s language or tone doesn’t match what you would expect from the supposed sender, it could indicate a fraudulent attempt. Executives typically have a consistent way of communicating.

- Links and attachments: Be cautious with links and attachments, even in emails that appear to come from senior executives. These can be traps set by attackers to steal credentials or install malware.

Important: While it’s important to be aware of and train staff about the indicators above, they are definitely not sufficient to identify all CEO frauds, especially sophisticated attempts. Attackers can use email spoofing techniques and generative AI to create messages that are virtually inseparable from real executive communications.

How to Prevent CEO Fraud Attacks

There are several measures that organizations can take to protect themselves against CEO fraud.

Implement Verification Procedures

Establish a multi-step authentication process for any requests involving financial transactions or sensitive information. This could involve verbal confirmation from the requesting party, using a pre-established phone number or face-to-face verification if possible. By requiring multiple forms of authentication, organizations can reduce the risk of falling victim to these scams.

Additionally, use email verification tools that can identify and flag potential phishing attempts. Setting up system alerts for unusual activity, such as requests for large wire transfers or changes in payment details, can also provide an early warning system. Train employees to recognize the signs of CEO fraud and respond by following these verification procedures.

Use Email Authentication Protocols

Protocols such as SPF (Sender Policy Framework), DKIM (DomainKeys Identified Mail), and DMARC (Domain-based Message Authentication, Reporting, and Conformance) authenticate the sender’s identity, reducing the risk of email spoofing. By implementing these protocols, organizations can ensure that only emails from verified sources reach their employees’ inboxes, blocking many fraudulent attempts that rely on impersonation.

Setting up DMARC policies also allows organizations to specify how unauthenticated emails should be handled—either quarantined or rejected outright. This provides reports on attempted attacks, offering insights into the types of phishing campaigns targeting the organization.

Controlled Access to Information

By implementing strict access controls, organizations can minimize the risk of information being inadvertently or maliciously shared with fraudsters. This involves categorizing data based on sensitivity and applying corresponding access restrictions, reducing the potential impact of phishing attacks aimed at acquiring confidential information.

Use a role-based access control (RBAC) system to ensure employees can only access the information necessary for their job functions. Regularly audit these access privileges to help maintain their effectiveness over time, identifying and rectifying any inappropriate access rights. Incorporate multi-factor authentication (MFA) to add another layer of security.

Use AI-Driven Email Security Solutions

AI-driven email security solutions proactively defend against CEO fraud by using machine learning and artificial intelligence to detect and prevent phishing attempts. These systems analyze email content, sender reputation, and communication patterns to identify anomalies that may indicate a fraudulent email. Advanced solutions can use large language models (LLMs) to detect the use of generative AI in phishing messages.

In addition to detecting impersonation tactics that traditional security measures might miss, these solutions can automatically quarantine suspicious emails, alert administrators, and provide users with warnings about potential risks. This level of automation allows the organization to respond quickly to potential threats and reduces the burden on IT departments.

Provide Training and Awareness

Training and awareness programs equip employees with the knowledge and skills to recognize and respond to CEO fraud attempts. By regularly conducting training sessions that simulate phishing scenarios, organizations can foster a culture of security awareness. These programs should cover the common indicators of CEO fraud, emphasizing the importance of verification processes.

Implement continuous awareness efforts to help keep employees vigilant against new and evolving phishing tactics. Provide updates on recent scam trends, along with reminders of the organization’s procedures for reporting suspected phishing attempts, to reinforce the message that security is a collective responsibility.

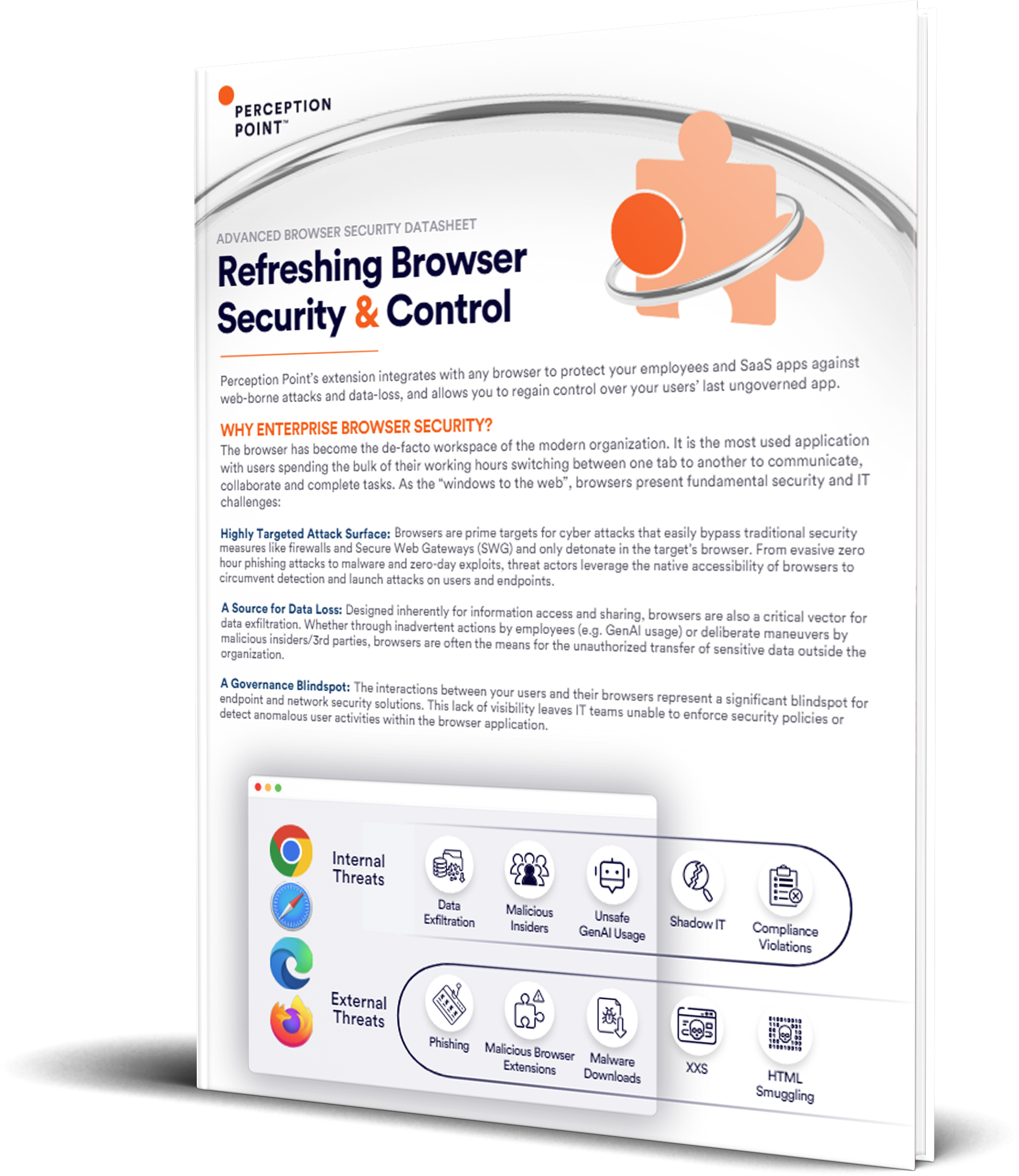

Preventing CEO Fraud and Phishing Scams with Perception Point

Patented AI-powered detection technology, scale-agnostic dynamic scanning, and multi-layered architecture intercept all phishing attacks, social engineering attempts, file & URL-based threats, malicious insiders, and data leaks. Perception Point’s platform is enhanced by cutting-edge LLM models to thwart known and emerging threats.

Reduce resource spend and time needed to secure your users’ email and workspace apps. Our all-included 24/7 Incident Response service, powered by autonomous AI and cybersecurity experts, manages our platform for you. No need to optimize detection, hunt for new threats, remediate incidents, or handle user requests. We do it for you — in record time.

Contact us today for a live demo or to learn more about our anti-phishing technology.

CEO fraud is a type of Business Email Compromise (BEC) scam that involves cybercriminals posing as company executives to deceive employees, customers, or partners into transferring money or sensitive information. CEO frauds exploit the authority of the CEO’s position to pressure targets into making hasty decisions without the usual verification processes.

Here are the common ways attackers carry out CEO fraud. Attackers might combine more than one of these techniques to make their phishing message more convincing and difficult to detect:

1. Email account Takeover

2. Domain name deception

3. Display name spoofing

4. Email header spoofing

5. Generative AI

Here are the most common targets of CEO fraud campaigns.

1. Finance

2. Human Resources

3. Executive Team

4. IT

Identifying CEO fraud requires vigilance and an understanding of common tactics used by fraudsters. The following are common indicators:

– Unexpected urgency

– Request for secrecy

– Changes in payment details

– Unusual email addresses

– Mismatched language and tone

– Links and attachments

There are several measures that organizations can take to protect themselves against CEO fraud.

– Implement Verification Procedures

– Use Email Authentication Protocols

– Controlled Access to Information

– Use AI-Driven Email Security Solutions

– Provide Training and Awareness